Download these free Donation Receipt Templates to help you prepare and print your donation receipts easily. I have also uploaded another good-looking Donation Slip Template that you might like to visit.

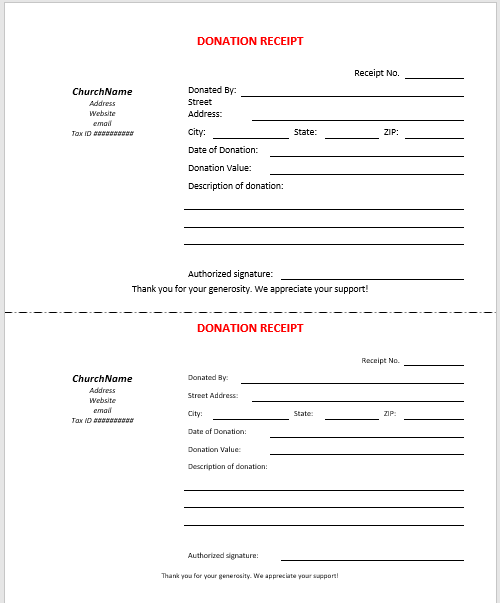

A printable donation receipt is a document provided by an organization or charity to a donor as proof of their donation. This receipt is typically printed on paper and includes essential details about the donation, such as the donor’s name, the amount donated, the date of the donation, and the organization’s name and contact information. Printable donation receipts are used for record-keeping, tax purposes, and to acknowledge and thank donors for their contributions.

This receipt template can be printed out and filled in with the necessary details, ensuring that donors have a proper record of their contributions for their personal records and tax purposes.

Here are the typical elements included in a printable donation receipt:

- Organization Information:

- Name of the organization

- Address

- Phone number

- Email address

- Website (if applicable)

- Donor Information:

- Name of the donor

- Address

- Email address (optional)

- Donation Details:

- Date of the donation

- Donation amount

- Description of the donation (if it is a non-monetary donation)

- Receipt Information:

- Receipt number (for tracking purposes)

- Signature of an authorized representative of the organization

- A statement indicating that no goods or services were provided in exchange for the donation (if applicable)

- Tax Information:

- A note mentioning the organization’s tax-exempt status (e.g., 501(c)(3) in the United States)

- Any other relevant tax information required by local laws

Download Official Donation Receipt Templates

Here is a preview of this Donation Receipt Template created using MS Word,

Here is the download link for this Donation Receipt Template,

Check out these Free Official Donation Receipt Templates with Tax Information.

Tips to Design Donation Receipts

A donation receipt is essential to design so that the donors can get potential benefits. Essential information is required to be presented in the comprehensive donation receipts so the following are some tips for designing donation receipts:

- Write the name of the donor, address, telephone number, and the amount or item that the donor vowed. If an item is given as a donation instead of money then it is essential to write the value of the item. Write a brief description of the donation including time, date, and place for the proper presentation.

- It is vital to include the disclosure that we have received no goods or services in exchange for donations. If there was an exchange such as a dinner or lunch plate and concert ticket as a result of the donation, list the value of exchanged goods.

- Do not forget to take the signature of one of the officials of the organization on the donation receipt. For more than one receipt at once, it will be better to issue them on the letterhead of the company so that the donor can get the proof of issuer of the document.

- Send the receipts to respective persons on time before January 31 of the following year so that the donors can file the taxes on time. Do not forget to keep each copy of the donation receipt with you for the future reference of the organization.

- It is compulsory to write the amount of donation or value of goods for the donation on the receipts because it will help you to avoid potential confusion.

- If you want to save your time then it is essential to have a donation receipts specimen according to the standards of IRS. Design a specimen in advance and then use it to generate donation receipts every time. It will help you to keep soft-copy and hard-copy donation receipts at the same time.

Download Sample Donation Receipt Forms

Here are ready-to-print Sample Donation Receipt Forms to help you print your donation receipts.

Download Donation Receipt Samples

Here is the preview and download link for these Donation Receipt Samples.

More Printable Donation Receipt Templates

Here are more printable donation receipt templates mostly two or three per page for bulk printing.