An income certificate is an important document used to claim your scholarship. You can also use it during admission to a school, college, or university to get some possible benefits. The income certificate is important for different purposes and usually, an application form is submitted to get an income certificate. If you want to get the income certificate, you have to submit the following documents:

- An application form to request for income certificate

- Copy of an identity card and other important national cards

- The income report of the applicant was verified by the concerned department

- Self-declaration certificate

- A copy of the school certificate

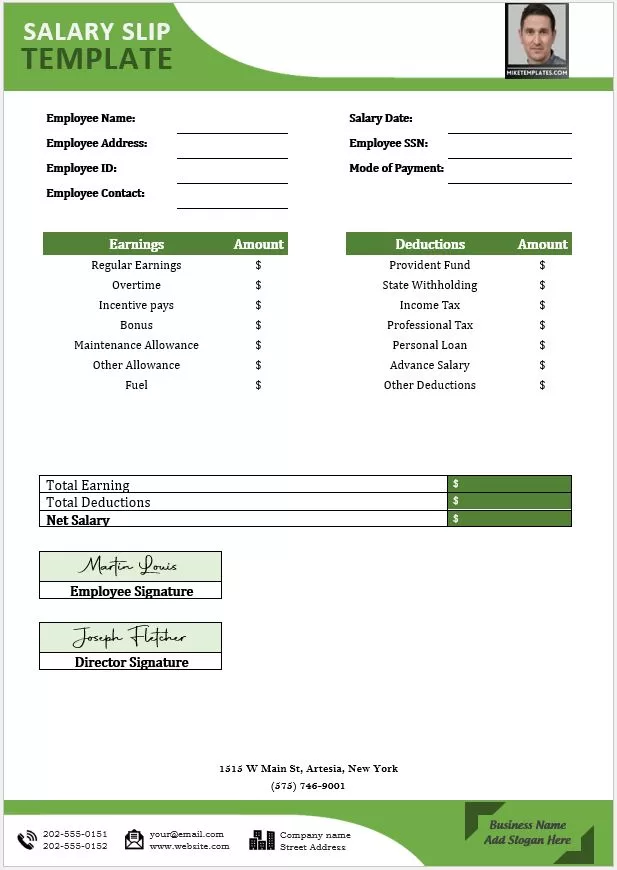

- A copy of the salary slip

The income certificate is developed to get certain benefits, including scholarships, discounts on purchases, passports, bank accounts, etc. Every state has its requirements and benefits linked with the income certificate. The income certificate is important for the family members to avail concession of fees and to become eligible for the tuition fee reimbursement and scholarship fee. Scholarships and financial aid are usually given to people unable to bear their educational expenses due to their poor financial condition. It enables concerned personnel to directly access deserved people to provide them with financial benefits.

The income certificate is also important to get a bank account because the banks ask for proof of your income before opening your account. It is important to get an income certificate to present proof of your income source and total monthly income. If you want to get a loan from a bank or any other financial institution, it is important to present your income certificate to become eligible for the loan. The income certificate helps you to get different electronic items and home appliances on installment.

Here is a preview of a Free Sample Income Certificate Template created using MS Word,

Here is the download link for this Income Certificate Template,

Surety Income Certificate

A special type of income certificate is known as a surety income certificate that is used to sell a covered call. These types of certificates were designed for investors who consider options as risky investments. They use these certificates to reduce the risk factor. The surety certificates are designed by considering three important components, including:

- What are the options?

- What are calls?

- What is meant by a covered call?

The option is a right, instead of obligation and it enables the person to buy or sell the underlying asset at a specific price and before a given date. The buyer can call the stock away at the given price after the required rise in the price of the stock. The ownership of underlying stocks can make the stock covered and enable the owner to charge a high price for the stock. The risk level of covered calls is really low because you have already declared the ownership of stock. You can get the advantages of covered calls by selling them at a high price.

The income certificates are designed for different purposes, and their uses are usually based on their nature. The income certificate should be issued by the concerned department with the signatures of authorized personnel. It should contain the name of the certificate bearer and the details of monthly or annual income with an income source.

You can also download Salary Slip Templates online to help you accomplish this task. Here is one such suitable template for your quick review.