You may heard about loan agreements before, a loan is an agreement of borrowing money from the lender and then repaying it after a specified time. The loan agreement may be in writing or oral, the written loan agreement is fully legal and it binds the borrower to the terms and conditions of the loan. Loan agreements may be for persons, companies, or groups of companies and can have different clauses according to the criteria and state of affairs. These loan agreements can be prepared by official lenders or other money lending firms, however, a loan agreement can also be prepared for a private loan. A conventional loan contract encloses a promissory note, loan repayment terms, default guidelines, late payment provisions, and clauses regarding litigation procedures.

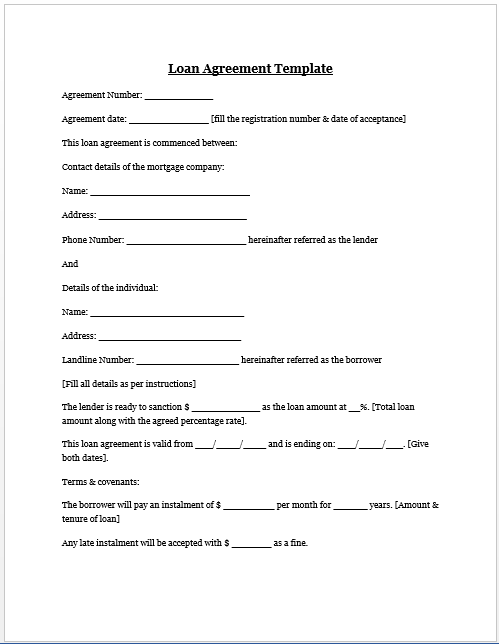

Here is a preview of this Loan Agreement Template,

Here are some instructions available to write a loan agreement, follow them if you want to make a successful loan agreement.

- Discuss the terms and conditions of credit with the borrower or the lender, it depends on you who are you in this case. If you want to avoid problems regarding loan agreements, discuss all the matters and facts with the opponent.

- Check out a sample of the loan agreement and check out that all the necessary information is available or not in the following sections, promissory note, principle, rate of interest, terms and conditions, payment, borrower, lender, and witness signatures, and precautions. You’ll need all of these sections to be in your contract.

- State whether the loan is to be pledged. This means that the borrower will have to sure you return of loan, by pledging an asset for the security of the loan. In case of loss, the lender can recover his loan from the pledged asset.

- Draft up the loan contract according to the pre-defined terms and conditions under the management of the legal representative. Since this is a lawful joining document, you will need a legal representative to review both the drafting of the agreement and the signing of the agreement.

- Compute the whole rate of interest on the credit using a paying-off schedule.

- Keep the language simple and easy to understand in the document, the document should not be littered with legalese to hold up in court.

- Make sure all the details are with the borrower (or lender, if you are the borrower) once the agreement is completed. Fix an engagement with the borrower to close and fund the loan.

By following these guidelines you might be able to avoid any kind of misunderstanding and misfortune in the course of your business deal. Holding a loan agreement saves you in any legal situation where you may need to use any of your friends or family members for the recovery of your money. It will be the only evidence of your transaction so have a preference to have a written agreement rather than an oral one. A good agreement can be obtained by using templates available for this purpose.

Here is the download link for this Loan Agreement Template,